The Purpose of Due Diligence Services in UAE

Due diligence services in UAE is a comprehensive and systematic investigation of a potential investment or business opportunity. It involves gathering, analyzing, and verifying information about a target company, its management team, its operations, financial performance, market, and competition. The goal of our service is to identify and assess potential risks and opportunities associated with the investment, enabling the investor to make informed decisions and manage those risks effectively.

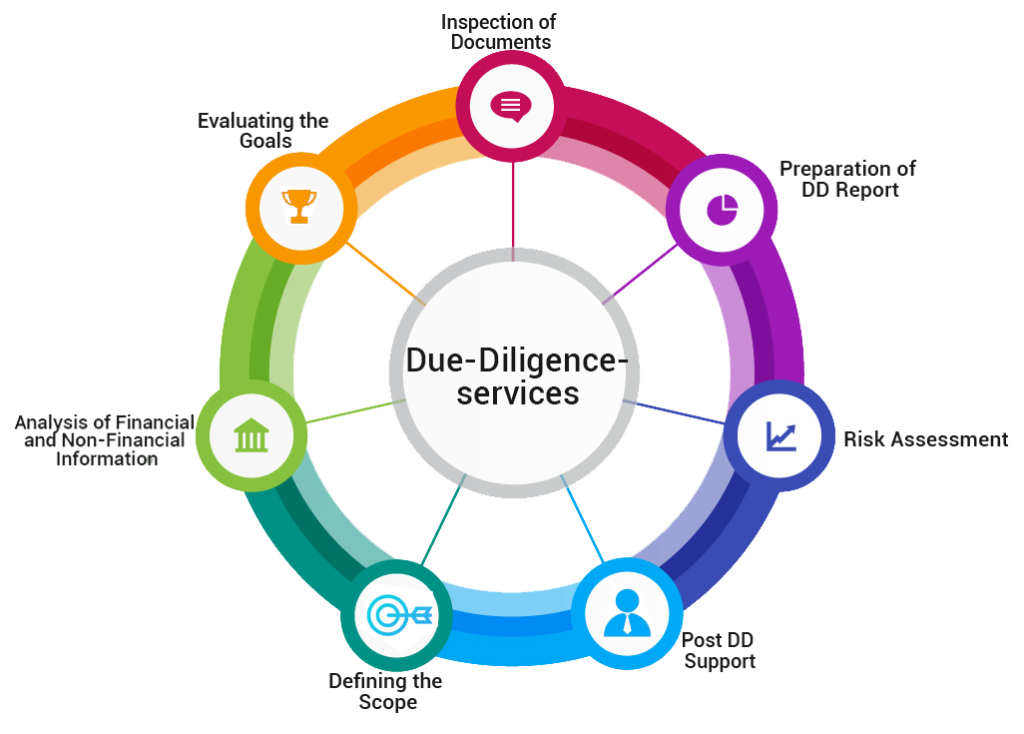

Our Methodology: A Comprehensive Approach to Due Diligence Services in UAE

Maxims offers Due Diligence services in UAE to help clients evaluate potential investments, acquisitions, or partnerships. The specific procedure for conducting Due Diligence (DD) may vary based on its purpose. However, there are certain steps that are considered standard for any type of due diligence. Maxims follows these standard steps to ensure that the due diligence process is comprehensive, efficient, and tailored to the client’s needs. These steps include evaluating the client’s goals, defining the scope of the process, analyzing financial and legal information, assessing risks, and providing ongoing support.

Evaluating the Goals

DD is the process of evaluating a company before making a business deal. The first step is to understand the client’s goals, expectations, and requirements. The auditor or consultancy firm works closely with the client to ensure the process aligns with their goals. This enables the process to be more efficient and effective, providing the necessary information for informed decision making. By managing expectations, the process can be conducted within the client’s timeline and budget.

Defining the Scope

Once the goals of the client have been evaluated, the next step in the DD process is to define its scope. This involves identifying the areas that need to be analyzed, such as financial statements, legal agreements, or operational processes. We will collaborate with the client to identify their data collection and information needs, and develop a plan and timeline for the process. This helps to ensure that the DD process is conducted efficiently and within the client’s desired time frame.

Analysis of Financial and Non-Financial Information

After defining the scope of the DD process, the next step is to conduct a thorough analysis of financial and non-financial information. This information can include financial statements, market data, and other relevant business information. Our team will use this data to gain a full understanding of the target company’s financial, legal, and operational aspects, allowing us to make recommendations to the client on potential risks, opportunities, and areas for further investigation.

Inspection of Documents

Another crucial step in the DD process is the inspection of relevant documents. This involves a review of legal documents such as contracts, licenses, and other relevant agreements. The purpose of this step is to ensure that the company being evaluated is in compliance with all relevant laws and regulations. Our team will assess any potential legal risks and liabilities that may affect the transaction or investment, and use this information to help the client make an informed decision.

Risk Assessment

The next step in the DD process is the assessment of risks associated with the target company. This step involves the evaluation of the company’s financial stability, market position, and other factors that may impact its performance. Our team will use the data gathered during the DD process to identify potential risks and vulnerabilities, enabling the client to make an informed decision. The risk assessment may also inform any potential renegotiation of the deal terms, such as pricing or warranties.

Preparation of DD Report

Based on the information gathered and analysed, the Maxims auditor or consultancy firm will prepare a DD report. The report will summarize the findings and provide recommendations for the client. It includes an executive summary, an overview of the target company, a review of the financial and legal aspects, and an analysis of the risks and opportunities identified. The report may also include a list of any outstanding issues or risks that require further investigation or attention and provides recommendations for the client.

Post DD Support

The final step in the DD process is to provide ongoing support to the client. This involves the provision of follow-up assessments, regular monitoring of the target company’s performance, and other related services. Ongoing support can help the client manage risks and stay informed on changes, aiding in successful DD outcomes. Our team will work with the client to provide ongoing support that is tailored to their specific needs and objectives.

Unlocking the Advantages Through Due Diligence

✨ Enables clients to decide with knowledge and to manage risks in partnerships, acquisitions, and investments.

✨ Evaluating target companies and markets offers clients a competitive advantage, enabling them to make strategic investment decisions for long-term success.

✨ Uncovering issues early in the investment process can help clients avoid costly mistakes and reduce the risk of financial losses or negative impacts.

✨ Effective outcomes can result in more favourable transaction terms, which will benefit customers in the long run.

✨ Ensuring investment compliance with relevant laws and regulations protects clients from potential legal or financial penalties.

✨ It provides clients with the information needed for informed investment decisions, increasing confidence and ability to respond to challenges.

Why Choose Us

Maxims services help clients identify and assess potential risks and opportunities associated with investments, acquisitions, and partnerships.

By partnering with Maxims, clients can maximize their success in the investment process and achieve their long-term goals.

Maxims offers access to the most recent tools and resources for data collection and analysis.

These resources enable investors to make confident investment decisions based on precise, current knowledge about their target company and market.

Maxims is committed to providing excellent customer service.

We guarantee that we will respond quickly to our clients’ needs.