Project Reports & Feasibility Studies Services in UAE

Feasibility Study Services in UAE refers to the range of professional services focused on providing comprehensive project reports and feasibility studies. These services are tailored to assist businesses, entrepreneurs, and organizations in evaluating the viability, potential risks, and opportunities associated with their projects and business ventures across various industries in the UAE. From initial concept assessment to in-depth analysis, these services aim to provide clients with strategic insights, data-driven assessments, and actionable recommendations to support informed decision-making, optimize resource allocation, and maximize the success potential of their projects within the dynamic business landscape of the UAE.

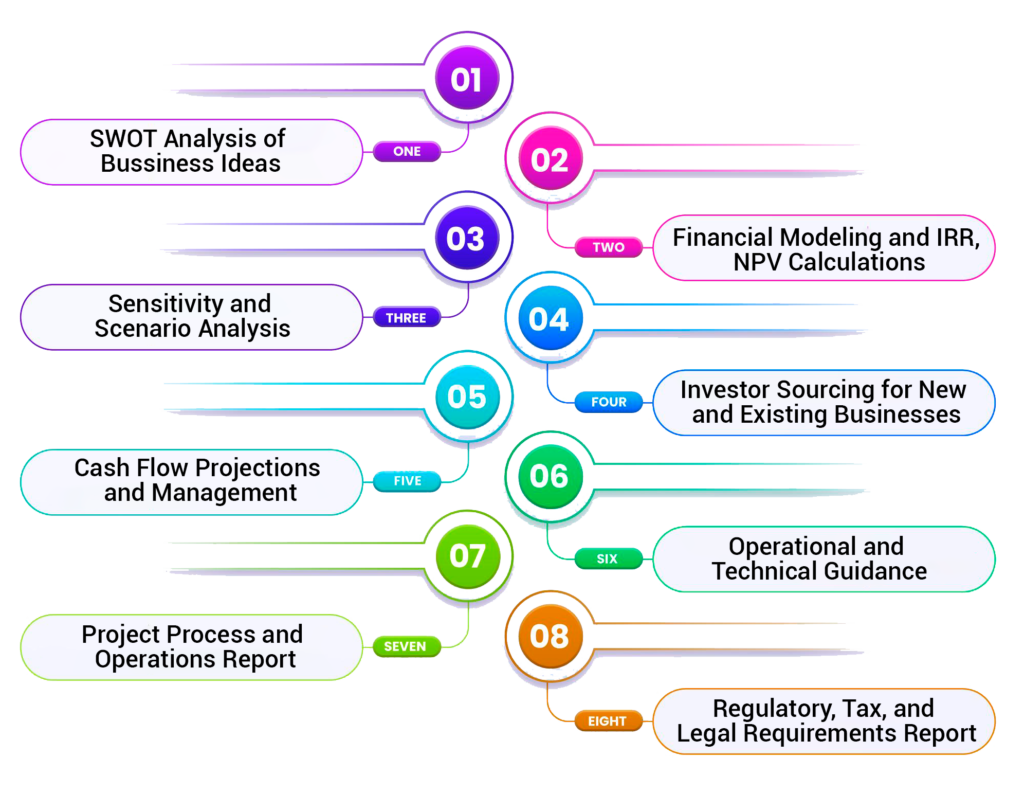

SWOT Analysis of Business Ideas

Maxim’s feasibility study services in UAE offer in-depth SWOT analysis to help you evaluate the strengths, weaknesses, opportunities, and threats of your business idea. SWOT analysis is a technique used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business idea. Strengths and weaknesses relate to internal factors, such as the company’s resources and capabilities, while opportunities and threats relate to external factors, such as market trends and competition. The analysis can provide valuable insights into the viability and potential success of a business idea. By identifying areas of strength and weakness, as well as potential opportunities and threats, businesses can make informed decisions about how to best allocate resources and mitigate risks.

Financial Modeling and IRR, NPV Calculations

Our experts use advanced financial modeling techniques to calculate IRR and NPV, giving you a complete picture of your investment’s expected return and net present value. Financial modeling involves using mathematical and statistical tools to create a financial representation of a business or investment. Internal Rate of Return (IRR) and Net Present Value (NPV) calculations are commonly used in financial modeling to evaluate the financial viability and profitability of investments. IRR is the rate at which an investment’s net present value equals zero, while NPV calculates the present value of cash inflows minus the present value of cash outflows. By performing these calculations in financial modeling, investors and businesses can make informed decisions about potential investments and projects.

Sensitivity and Scenario Analysis

Maxim’s feasibility study services in UAE provide sensitivity and scenario analysis services to businesses, which help in assessing the impact of changes in different variables on financial projections and business viability. With sensitivity analysis, the effects of changes in a single variable can be tested, while scenario analysis involves considering multiple variables and different outcomes. This service helps investors and businesses evaluate potential risks and opportunities, enabling them to make informed financial decisions and better plan for the future.

Cash Flow Projections and Management

Maxims Auditors and Consultants offer accurate and comprehensive cash flow projections and management services to help businesses plan and manage their cash resources effectively. Our team provides expert forecasting and tracking of cash movements to anticipate future cash flows and ensure sufficient funds are available for financial obligations. We also offer management services to monitor and control cash flows to support business operations and investments. With our help, businesses can ensure their cash flow is optimized, leading to better financial stability and success.

Investor Sourcing for New and Existing Businesses

Our feasibility study services in UAE provide businesses with expert investor sourcing services to help secure funding for their ventures. Our team has a comprehensive understanding of the investor landscape, including the investment criteria used to evaluate potential opportunities. We work with businesses to develop targeted approaches that reach potential investors and present compelling business cases that align with their investment goals. With our investor sourcing strategy, businesses can secure the funding they need to start new ventures or grow existing operations.

Operational and Technical Guidance

Our team offers expert operational and technical guidance to help businesses improve their efficiency and effectiveness. This service involves analyzing current processes and systems to identify areas for improvement, recommending best practices to streamline workflows, and providing guidance on implementing new technology. With our help, businesses can optimize their operations and technical capabilities to reduce costs and increase productivity. Our goal is to provide businesses with the guidance they need to achieve their objectives and succeed in their respective industries.

Project Process and Operations Report

Our team provides a comprehensive project process and operations report to guide businesses in the successful completion of their projects. The report includes detailed recommendations for best practices and process improvements, as well as an outline of the steps involved in executing the project, including resource allocation, task delegation, and timelines. We conduct a thorough analysis of the project’s progress, highlighting successes and identifying areas for improvement to ensure that the project is completed successfully and efficiently. With our expert guidance and support, businesses can streamline their processes and optimize their operations to achieve their project goals.

Regulatory, Tax, and Legal Requirements Report

Maxims Auditors and Consultants provide businesses with a comprehensive regulatory, tax and legal requirements report to ensure full compliance with all applicable laws and regulations. The report covers key considerations and obligations, outlining the tax requirements and other legal obligations that businesses must meet. With this report, businesses can ensure that they are operating within the legal and regulatory environment in which they operate, reducing the risk of penalties and legal consequences. Our report is designed to help businesses meet their legal and regulatory obligations while achieving their business objectives.

Benefits of working with Maxims Auditors and Consultants

✨ Data-Driven Recommendations: Our experts use data-driven analysis and recommendations, providing clients with precise, actionable insights for their business.

✨ Financial Planning and Management: Our financial modeling, cash flow projections, and management services help clients plan and manage their resources effectively, leading to improved financial outcomes.

✨ Compliance with Regulations: Our regulatory, tax, and legal requirements reports ensure clients are aware of and in compliance with all relevant regulations, taxes, and laws, protecting their business and investment.

✨ Project Success Roadmap: Our project process and operations reports provide a roadmap for project success and recommendations for process improvements, enabling clients to successfully complete their projects.

✨ Expert Guidance: Our team of experts provides operational and technical guidance, helping clients run their business more efficiently and effectively.

Why Choose Us

Our team has extensive expertise in SWOT analysis, financial modeling, cash flow management, and more.

We provide valuable insights and guidance for businesses to succeed.

Maxims offers comprehensive business consulting services.

We place great importance on building strong relationships with our clients and offer customized solutions to meet their individual needs.

By choosing Maxims, businesses can benefit from their expertise and achieve success.

Maxims has a proven track record of success and delivers high-quality services.