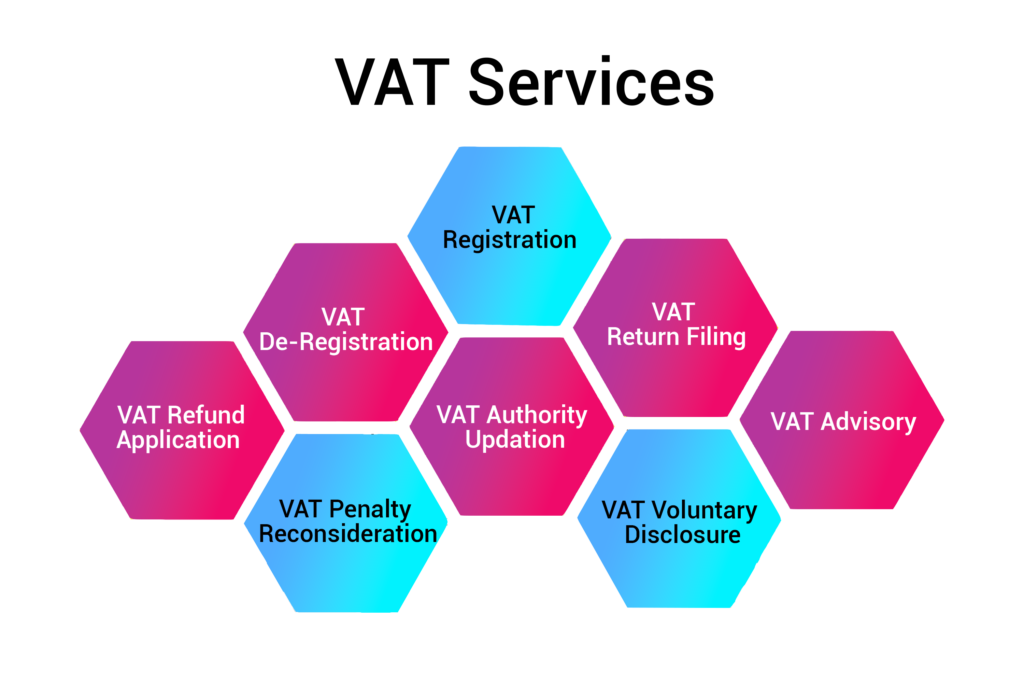

VAT Services in UAE

Maxims Auditors and Consultants stands out as the trusted partner for fulfilling all VAT services in UAE. With a team of seasoned experts boasting extensive knowledge in VAT regulations, we offer a comprehensive suite of services tailored to your needs. Whether it’s VAT registration, VAT filing, VAT deregistration, VAT advisory, or managing VAT penalties, we provide thorough and reliable assistance at every step. Our commitment to excellence ensures that businesses receive top-notch support, allowing them to navigate the complexities of VAT compliance with ease and confidence.

VAT Registration

Maxims VAT services in UAE help businesses to register for VAT in a hassle-free manner and ensure that their business is in compliance with the latest regulations. VAT Registration in the UAE is a mandatory requirement for businesses that carry out taxable activities within the UAE and whose taxable supplies and imports exceed the mandatory registration threshold of AED 375,000. Businesses that are registered for VAT must charge VAT on taxable supplies of goods and services at the applicable rate and file periodic VAT returns with the Federal Tax Authority (FTA). VAT Registration in the UAE is a mandatory requirement for businesses that carry out taxable activities within the UAE and whose taxable supplies and imports exceed the mandatory registration threshold of AED 375,000. Businesses that are registered for VAT must charge VAT on taxable supplies of goods and services at the applicable rate and file periodic VAT returns with the Federal Tax Authority (FTA).

VAT De-Registration

VAT De-Registration is the process of cancelling a business’s registration for Value Added Tax (VAT). This typically happens when a business’s annual turnover drops below the VAT registration threshold and the business no longer meets the criteria for being registered for VAT. The process of de-registering involves the submission of a de-registration form to HMRC, and the cancellation of the business’s VAT registration. If your business is no longer liable for VAT, we can assist with the de-registration process. Also we provide the business valuation and business restructuring services in UAE.

VAT Return Filing

Our experts can assist with the timely and accurate filing of VAT returns, ensuring that your business stays compliant. By filing a VAT return, a business informs the appropriate tax authority of the value added tax (VAT) it has collected from consumers within a specified time period as well as the VAT it has forked over on supplies of products and services. Making sure that the business has paid the appropriate amount of VAT is the goal of filing a VAT Return.

VAT Refund Application

If you are eligible for a VAT refund, we can assist with the application process to ensure that you receive your refund in a timely manner. VAT Refund Application in the UAE is an online portal provided by the UAE Federal Tax Authority (FTA) to facilitate the process of claiming back Value Added Tax (VAT) for UAE-based businesses. The portal allows businesses to apply for a refund of the VAT they have paid for purchases of goods and services. Through the portal, businesses can submit their refund applications, track the status of their applications, and receive their refunds.

VAT Authority Updation

We can help you keep your VAT records up-to-date with the latest regulations and ensure that you remain compliant. VAT Authority Updation in the UAE is a process that facilitates the registration of businesses for Value Added Tax (VAT) in the UAE. It is an online portal that allows businesses to register and make changes to their VAT information such as VAT rate, contact details, and other relevant information. It also enables businesses to view their VAT liabilities and payments.

VAT Penalty Reconsideration

If your business has received a VAT penalty, we can assist with the reconsideration process to ensure that it is resolved in a fair and just manner. VAT Penalty Reconsideration in the UAE is a process whereby an individual or business can apply to the UAE Federal Tax Authority to review and potentially reduce a penalty that has been imposed for a breach of Value Added Tax (VAT) laws. The process involves submitting a detailed reconsideration request to the FTA, along with any supporting documents and evidence, to demonstrate why the penalty should be reconsidered and potentially reduced.

VAT Voluntary Disclosure

Our team can assist with voluntary disclosure, allowing businesses to rectify any past errors or omissions and come into compliance with the latest regulations. VAT Voluntary Disclosure in the UAE is a program that was introduced by the Federal Tax Authority in order to encourage taxpayers to voluntarily disclose any underpayment or non-payment of Value Added Tax (VAT). This voluntary disclosure process allows businesses to make up any discrepancies in their VAT returns and pay any outstanding taxes without facing any penalties or financial sanctions.

VAT Advisory

Our experts provide comprehensive VAT advisory services to ensure that your business stays compliant and can make informed decisions. VAT Advisory in the UAE is a service that provides advice and assistance to businesses in the UAE on how to comply with the Value Added Tax (VAT) regulations. This includes providing guidance on the registration process, preparing and filing returns, understanding the impact of VAT on business operations, and managing the audit process. In addition to providing guidance on compliance requirements, VAT Advisory services can also provide advice on how to optimize VAT costs and revenue.

Benefits of Maxims Auditors and Consultants VAT Services in UAE

✨ Hassle-free registration: We can help you register for VAT in a hassle-free manner and ensure that your business is in compliance with the latest regulations.

✨ Accurate return filing: Our experts can assist with the timely and accurate filing of VAT returns, ensuring that your business stays compliant.

✨ Eligible refund recovery: If you are eligible for a VAT refund, we can assist with the application process to ensure that you receive your refund in a timely manner.

✨ Up-to-date records: We can help you keep your VAT records up-to-date with the latest regulations and ensure that you remain compliant.

✨ Penalty reconsideration: If your business has received a VAT penalty, we can assist with the reconsideration process to ensure that it is resolved in a fair and just manner.

✨ Peace of mind: With our expert VAT services, you can have peace of mind knowing that your business is in compliance with the latest regulations.

Why Choose Us

Timely and accurate services

We provide timely and accurate VAT services, including return filing and refund application, to ensure that your business stays compliant.

Tailored solutions

We provide customized VAT services to meet the specific needs of your business and ensure that you are in compliance with the latest regulations.

Expertise

Our team of experts has extensive experience in VAT regulations and a deep understanding of the latest laws and compliance requirements.

Cost-effective solutions

Our VAT services are cost-effective and help to minimize the administrative burden and costs associated with VAT compliance.

Peace of mind

With our expert VAT services, you can have peace of mind knowing that your business is in compliance with the latest regulations and protected from penalties and fines.

Hassle-free process

Our experts make the VAT process hassle-free by taking care of all the administrative tasks, so you can focus on growing your business.