Accounting services are essential for businesses in the UAE, as they help to ensure that records are kept accurately and that important financial decisions are made with the right information. Accounting services are also important for tax compliance, reducing the risk of liability and financial penalties. However, many business owners may not be aware of the potential Return on Investment (ROI) associated with accounting services. ROI in Accounting is an analysis tool used to measure the performance of investments and evaluate the efficiency of business operations. It helps organizations assess the financial impact of investments, identify areas of improvement and maximize profits.

The efficiency and effectiveness of a business are measured by the ROI. It is calculated by dividing a company’s net income by all of its assets. ROI is a term used in accounting to describe the performance of a specific investment as well as the profitability of a company. To determine which investments are the most profitable, it is also used to compare them. Businesses can determine their overall performance and which investments are yielding the highest returns by calculating their ROI.

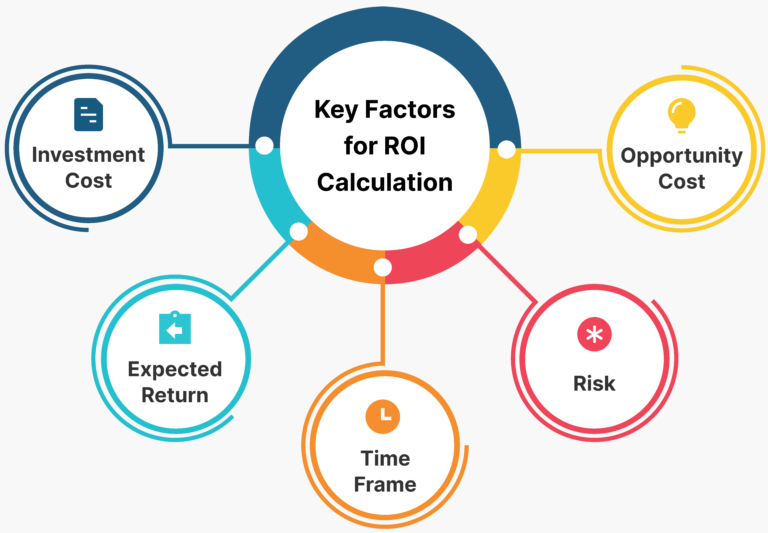

When evaluating the ROI of accounting services for your business, there are several factors to consider. These include:

The cost of the investment should be the first factor to consider when calculating the ROI. This includes the amount of money invested and any additional costs associated with the investment, such as maintenance and training.

The second factor to consider when calculating the ROI is the expected return on the investment. This includes the projected revenues, savings, and other benefits that will be generated by the investment.

The third factor to consider when calculating the ROI is the time frame in which the return on the investment is expected to be realized. This should be taken into account when projecting the return on the investment.

The fourth factor to consider when calculating the ROI is the risk associated with the investment. This includes the potential for losses, as well as the potential for gains. The risk associated with an investment should be taken into account when calculating the ROI.

The fifth factor to consider when calculating the ROI is the opportunity cost associated with the investment. This includes the potential cost of foregoing other investments or opportunities in order to make the investment in question. This should be taken into account when calculating the ROI.

For example, if the total cost of the software, additional services, and implementation is $2,000 and the estimated savings are $500, the ROI would be calculated as follows:

500 / 2000 = 0.25

0.25 x 100 = 25% ROI

ROI is a measure of the profitability of an investment. It is typically expressed as a percentage and is calculated by dividing the net gain of an investment by the cost of the investment. ROI is used to measure the efficiency of an investment and to compare the efficiency of a number of different investments. It is often used when making decisions about which investment to pursue. Analyze the quality of the services, time saved, and the value of the insight when assessing the ROI of accounting services for your business. Consider the long-term benefits of the accounting services when evaluating the ROI for your business. With the right information, you can make informed decisions that can have a positive impact on the ROI of your business.

Are the numerous accounting solutions on the market making you feel overwhelmed? You can get free, personalized advice from our experts, to help you find the best option for your company. Contact us now. Don’t wait any longer; utilize our professional guidance now!