Due diligence in mergers and acquisitions provides key information needed to make informed decisions and optimize the chances of success during mergers and acquisitions. By thoroughly researching the financial, legal, and operational status of the target company, decision-makers gain a more complete understanding of the transaction and are better equipped to determine their desired course of action. In this blog post, we will explore the best practices for conducting due diligence in mergers and acquisitions (M & A) transactions, highlighting key considerations and strategies for maximizing the chances of a successful deal.

Due diligence is of paramount importance in M & A transactions. It involves conducting a thorough investigation and analysis of the target company to evaluate its financial, legal, operational, and commercial aspects. The significance of due diligence lies in its ability to provide critical insights and mitigate risks associated with the deal. It helps the acquiring company understand the target’s financial health, uncover any potential liabilities or contingencies, assess legal compliance, evaluate operational capabilities, and analyze market position. The key objectives of the due diligence process include making informed decisions, identifying synergies, negotiating favourable terms, and ensuring a smooth integration post-acquisition.

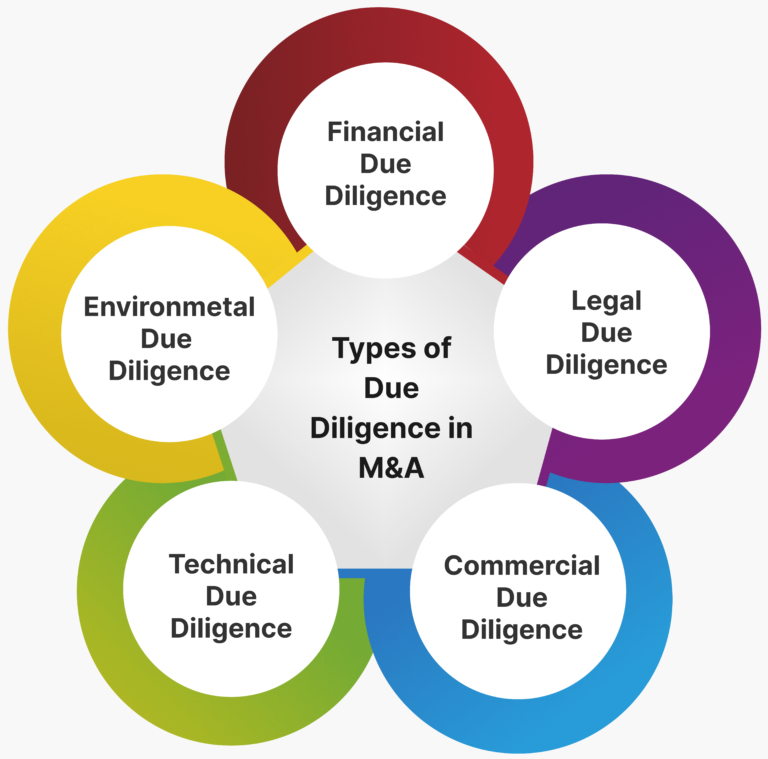

Here are the key types of due diligence commonly performed in M&A transactions:

Financial due diligence involves a comprehensive examination of a business’s financial well-being, encompassing both historical and current performance. This assessment is critical in determining the financial benefits of the transaction for the buyer. Additionally, as part of the process, the buyer’s team thoroughly reviews the seller’s financial statements, which provide a summary of accounting outcomes for a specific period, such as a fiscal or calendar year. The primary objective of financial due diligence is to establish future forecasts while carefully considering any potential risks. An important aspect involves meticulous scrutiny of financial statements, accounting policies, assets, liabilities, tax obligations, cash flow, and projections to verify their accuracy and reliability.

Legal due diligence involves the collection and evaluation of all legal documents and information related to the target company, allowing both the buyer and seller to examine potential legal risks. During this process, the acquiring company can determine if the target company has any ongoing legal proceedings and gain an understanding of the type of proceedings involved. Additionally, the acquiring company can investigate the target company’s contractual agreements, any legal restrictions, intellectual property holdings, and target markets.

Commercial due diligence involves the systematic evaluation and analysis of a target company’s commercial aspects by the buyer. The primary purpose of conducting commercial due diligence is to thoroughly investigate, assess, and verify the fundamental strategic rationale and value proposition that underlie an acquisition or financing agreement. This process ensures that the buyer has a solid understanding of the target company’s commercial viability and the potential value it can generate, forming the basis for the deal.

Tech due diligence in M&A refers to a comprehensive and unbiased assessment of a product’s technical condition, encompassing factors such as code quality, decision-making logic, and risk evaluation. Normally, it is the investor who takes the initiative to initiate the tech due diligence process. Through technical due diligence, the development team can acquire a thorough understanding of the product’s advantages and disadvantages, while investors can ensure that they are making an informed investment decision regarding the product.

Environmental due diligence is a thorough investigation that assesses the environmental risks and issues affecting a commercial property. It involves a comprehensive examination of the site’s past activities, present operations, and the surrounding vicinity and liabilities that could impact the property or business. The purpose of this investigation is to gain a comprehensive understanding of the environmental conditions and associated risks to make informed decisions and mitigate potential liabilities related to the property.

Here are some essential tips and practices to streamline the due diligence process for your company’s merger or acquisition.

i). Initiate with a due diligence checklist

While buyers often provide a due diligence checklist, it’s beneficial to obtain a sample checklist in advance and ensure your company records are updated and well-organized. Maintaining a virtual data room over a weekend or within hours, containing all necessary due diligence information, is not only essential for potential acquisitions but also helps establish a valuable discipline as your company grows.

ii). Stage the sharing of sensitive information

Buyers aim to gain a deep understanding of your business. They will request information on products, customers, sales pipeline, financial statements, technology, personnel, and more. While transparency and disclosure are crucial, it’s important to protect your intellectual property as a seller. Share information progressively, aligning with the buyer’s commitment level and the sensitivity of the requested data.

iii). Address liabilities

Litigation threats raise concerns for buyers, and it’s vital to address them proactively. Sellers may be unaware of litigation exposures until the due diligence process uncovers them. These exposures can stem from ex-employees, customers, vendors, intellectual property issues, or outdated company practices. Address unresolved litigation well in advance of buyer interest, as it can diminish the value and impede the deal.

iv). Provide support throughout the process

During due diligence, buyers seek to comprehend in weeks what you have built over years. It is your responsibility to facilitate the process and guide the buyer through the learning curve. Promptly respond to requests for missing data and information. Your organized and detailed responses to due diligence inquiries in still credibility and confidence in the buyer, showcasing the quality of your business.

In this article, we have provided recommendations on effective practices for due diligence in mergers and acquisitions smoothly. While the specific factors involved in the due diligence process may vary from one industry to another. However, the practises described above can be applied to any industry.

Maxims is a professional firm specializing in auditing and consulting services, based in Dubai. We deliver a comprehensive range of accounting software services, auditing, tax consulting, and due diligence services. With our team’s diverse skill set and extensive technical knowledge, Maxims excels in providing exceptional services to clients across the UAE.