Corporate tax is a tax on the profits earned by companies and businesses in the UAE. The UAE government imposes corporate tax on both local and foreign companies operating in the country, with the exception of some free zones that offer tax exemptions. The UAE corporate tax rate is currently set at 0%, making it an attractive destination for businesses and investors. However, companies in certain industries may be subject to specific taxes or fees, such as the oil and gas industry, which is subject to a tax on production. It is important for businesses operating in the UAE to understand their tax obligations and comply with the regulations set forth by the government.

In the UAE, only foreign banks and oil companies are subject to corporate tax, with the standard rate set at 20%. However, most other businesses, including those in free zones, enjoy tax-free status on their profits, making the UAE an attractive destination for international investment and entrepreneurship.

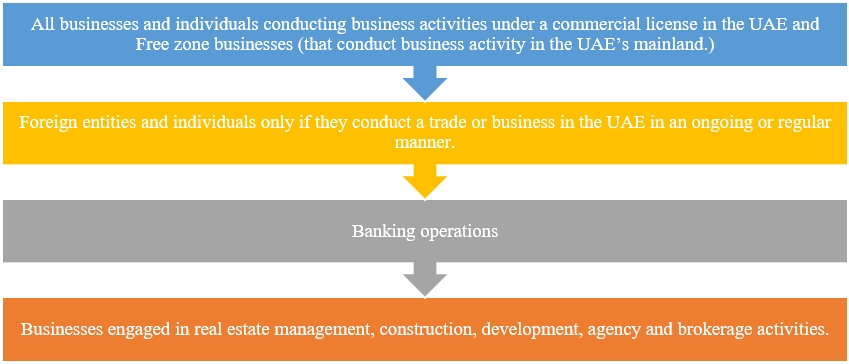

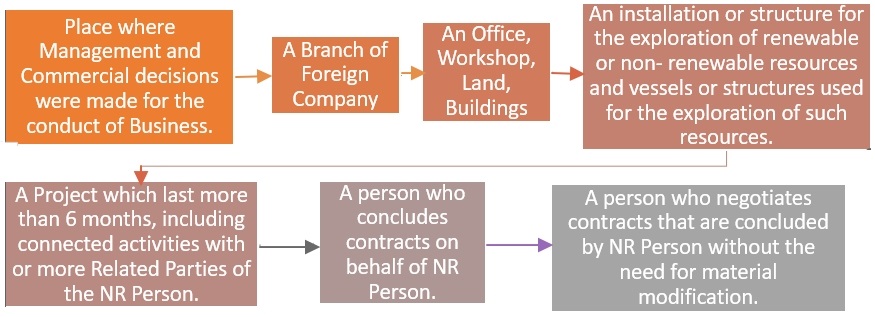

Residents of the UAE, such as businesses and individuals registered in the UAE and Free Zones, and multinational corporations that are effectively managed in the UAE, are subject to taxation on income derived from both domestic and foreign sources. Non-residents, on the other hand, are only taxed on income earned from within the UAE. This includes corporate tax on taxable income attributable to any permanent establishment in the UAE or derived from state sources. Residency for corporate tax purposes is not determined by residence or domicile but instead by specific criteria set out in the Corporate Tax Law in accordance with the OECD Model Tax Convention on Income and Capital.

The following points outlined above do not apply to a Non-Resident (NR) Person’s Personal Establishment if it is only used for activities such as,

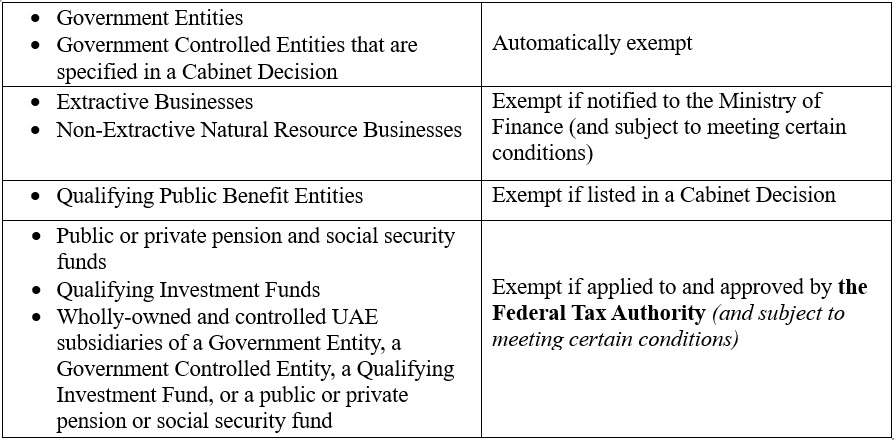

Some businesses or organizations are not required to pay UAE Corporate Tax because of their significant role and contribution to the society and economy. These entities are called Exempt Persons and include,

1. Free Zone Persons:

2. Other Government & Related Entities:

A Person shall be considered as a connected person of a taxable person, the following criteria must be met:

A “Parent Company” or a Resident Person can apply to form a “Tax Group” with one or more “Subsidiaries”, which are also Resident Persons, as long as certain conditions are met.

The Parent Company is responsible for combining the financial results, assets and liabilities of each Subsidiary during the relevant Tax Period, excluding transactions between the Parent Company and each Subsidiary that is a member of the Tax Group. The unutilized Tax Losses of a Subsidiary that joins a Tax Group become carried forward Tax Losses of the Tax Group, which can be used to offset the Taxable Income of the Tax Group.

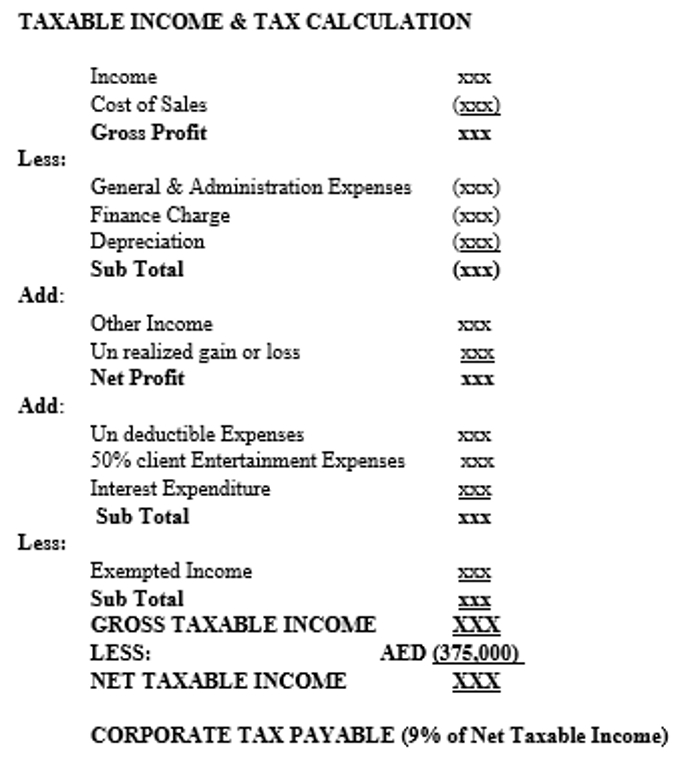

The taxable income of future tax periods can be reduced by offsetting tax loss against it. However, this offset cannot exceed 75% of the taxable income. In certain cases, a tax loss or a portion of it can be used to decrease the taxable income of another taxable person, provided both of them are resident juridical persons and either one of them holds at least 75% ownership interest in the other, or a third party holds at least 75% ownership interest in both of them.

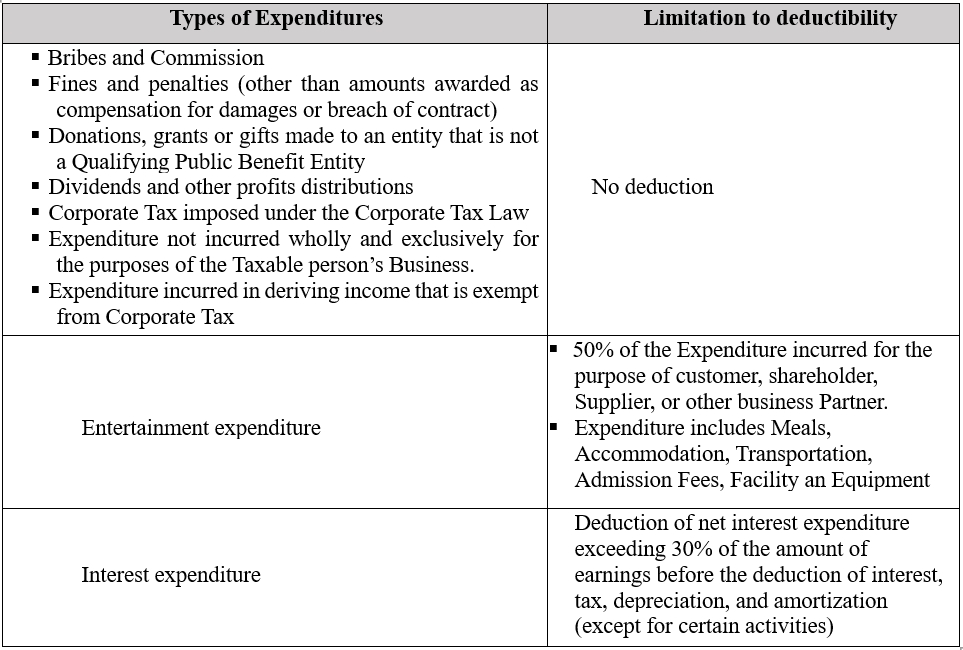

Certain expenses can be deducted under regular accounting rules, they may not be fully deductible for Corporate Tax purposes. These expenses need to be added back to the Accounting Income to determine the Taxable Income. Some examples of expenses that may not be fully deductible include:

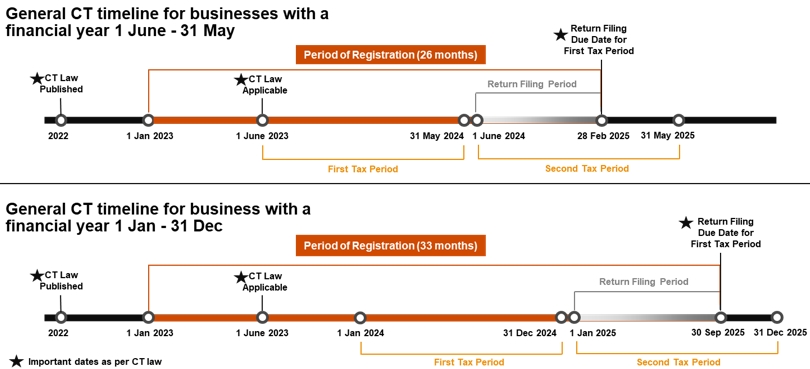

The following are examples of the registration, filing, and payment deadlines for taxable entities with Tax Periods (Financial Year) ending on 31 May or 31 December.

Our team of highly skilled tax consultants in Dubai possesses vast knowledge in tax law advisory, arbitration, compliance, and litigation. Both residents and foreigners in Dubai can rely on our tax consultants for valuable insights and up-to-date information on Corporate tax in the UAE. Our corporate tax consultants in Dubai cater to the needs of both local and global businesses operating in the UAE. If you need more information about our additional services, feel free to get in touch with our consultants based in UAE.