Skip to content

Skip to footer

To streamline the country’s taxation structure, the government has set up a new chapter of tax compliance and regulations within the business landscape of the UAE. Whereas, each institution guarantees to contribute collectively to the socio-economic development of the country. Under the existing corporation tax laws, failure to file a Corporate Tax (CT) return is punishable by a penalty. The Ministry of Finance has announced that these amendments introduced in the UAE will come into effect from 1 August 2023 as per Cabinet Decision No.75/2023. According to Federal Decree-Law No. 47/2022, these amendments established penalties for taxation violations on businesses and companies including penalty for late registration.

To register for CT, the Federal Tax Authority (FTA) has provided certain deadlines to avoid tax evasion by taxable persons. The law, which came into effect in June last year, applies to tax periods beginning on or after June 1, 2023. The new FTA decision, which entered into force on March 1, 2024, has given a deadline for natural and legal citizens. Also, non-resident companies must apply for corporate tax registration.

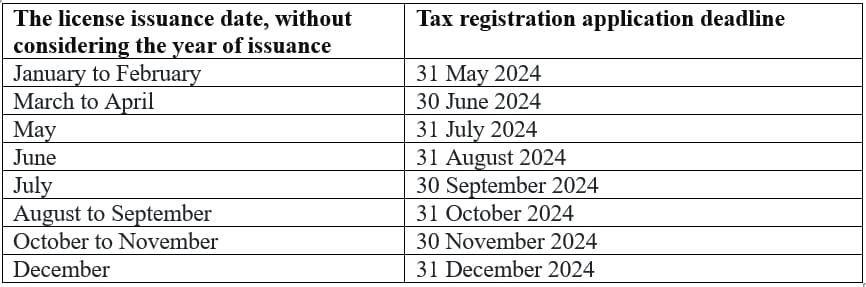

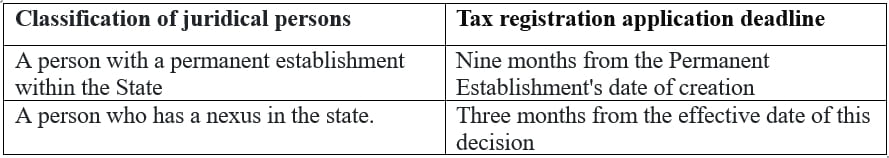

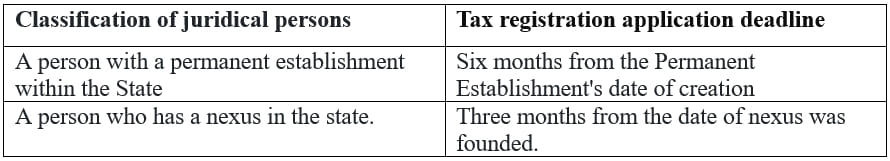

Before the effective date of the aforesaid decision, a resident person, incorporated or otherwise established or permitted resident, shall submit a tax registration application in accordance to the schedule below:

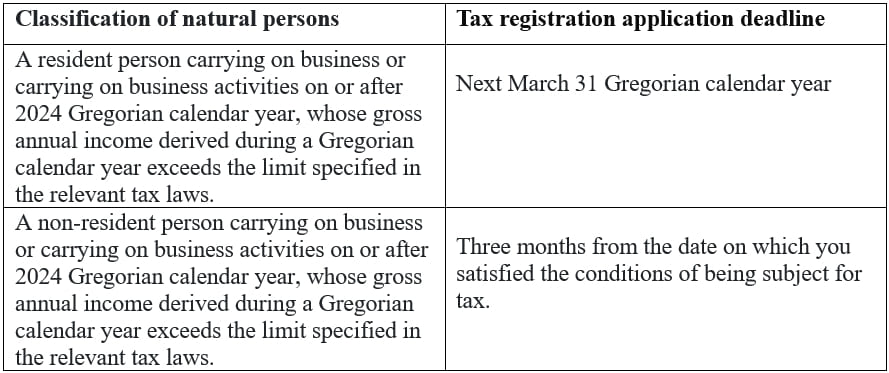

A natural person carrying on business or business activities in the state must file a tax registration application in accordance to the schedule, mentioned in the left side table.

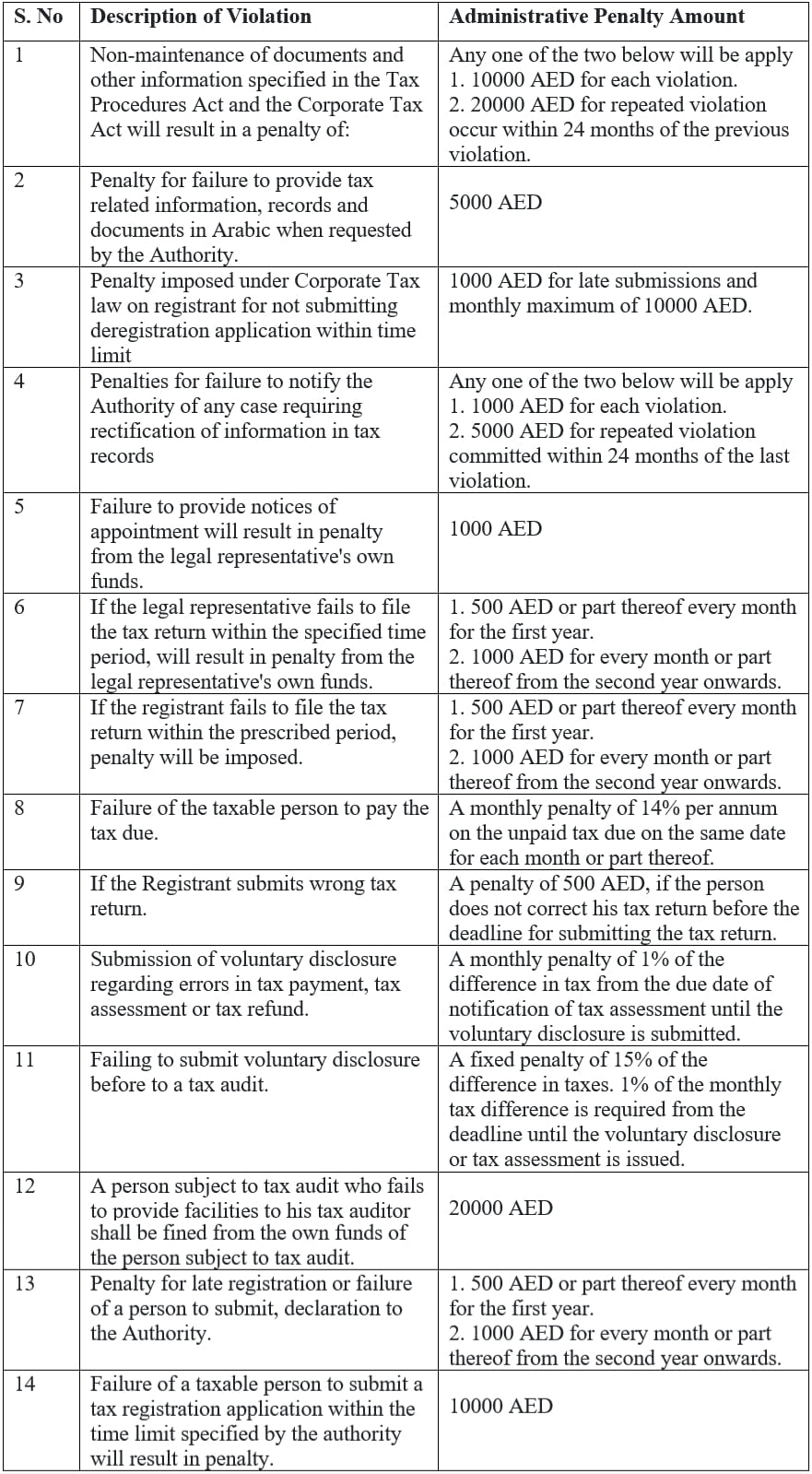

2023 Cabinet Decision No. (75) is a schedule of violations and administrative fines related to the application of Federal Decree-Law No. (47) of 2022 on taxation of corporations and businesses.

According to the UAE CT Law, taxable persons and certain types of exempt persons (such as qualified public benefit organizations and qualified investment funds) must register with the Tax Authority (CT) to obtain a Tax Registration Number (TRN). As per the law promulgated by FTA, the deadline for obtaining exemption and CT registration for certain categories of exempted persons under the UAE CT Law was presented in Decision No. 7 of 2023. To learn how to register the CT online, read the instruction below.

A further fixed penalty will be levied for subsequent monthly’s delay.

Interest is charged on the overdue tax amount from the due date till the full amount of tax is paid.

Also Read: How Corporate Tax is Calculated in UAE

If your company needs to manage financial transactions, procedures, reports and more, Maxims is the best solution. Our account management software can handle your company’s expanding needs. It provides a complete solution for UAE VAT, for example from generating tax invoices to completing VAT returns. Key features include: