Corporate tax registration is an important step for any business entity, ensuring compliance with legal requirements and facilitating smooth operations in the tax landscape. Understanding the timeline for this process is essential for businesses to plan effectively and avoid any potential penalties or delays. The timeline for corporate tax registration varies depending on factors such as the type of entity, jurisdiction and applicable tax laws. In this blog post, we provide much more details of the timeline for corporate tax registration including resident juridical persons, non-resident juridical persons, and natural persons. Also offering valuable tips and guidance for businesses at every stage of the journey.

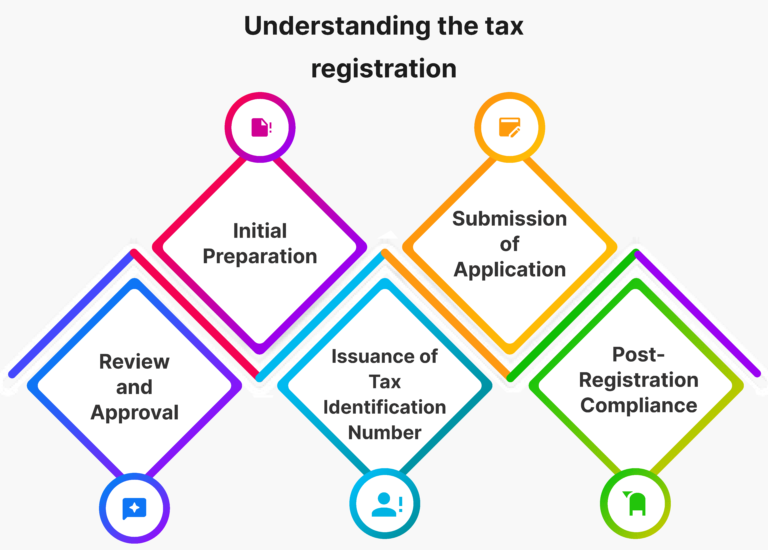

The timeline for corporate tax registration typically begins with initial preparation. This stage involves gathering relevant documentation and information required for registrations. It includes company incorporation documents, business licenses, identification documents of directors and shareholders, and other financial records. Thorough preparation at this stage can streamline the registration process and prevent unnecessary delays.

Once the necessary documentation is gathered, the next step is to submit the application for to the appropriate tax authorities. The timeline for this stage can vary depending on factors such as the efficiency of the tax authority’s processing procedures and the completeness of the application. It’s important to ensure that the application is accurate and complete to avoid any rejections or requests for additional information. It could prolong the registration process.

After the application is submitted, it undergoes review by the tax authorities to verify the information provided and assess the eligibility of the business entity. This stage may involve inquiries or requests for clarification from the tax authorities, which can impact the timeline for approval. Businesses should be prepared to respond promptly to any queries to speed up the review process and facilitate timely approval.

The registered business entity receives a Tax Identification Number (TIN) from the tax authorities after the application has been successfully reviewed and approved. The TIN serves as a unique identifier for tax purposes and is essential for fulfilling various tax obligations, such as filing tax returns and making tax payments. The timeline for receiving the TIN can vary depending on the processing times of the tax authorities and any additional requirements.

After obtaining the TIN, businesses are required to maintain continuous adherence to corporate tax requirements. It includes filing tax returns, maintaining accurate financial records, and continuous adherence with relevant tax laws and regulations. Timely compliance is important to avoid penalties and maintain good standing with the tax authorities.

Federal Tax Authority (FTA) Decision No. 3 of 2024, specifies the precise timetable for corporate tax registration of taxable individuals. AED 10,000 in administrative penalties would be imposed for noncompliance with the deadline.

Initially, the company must gather all necessary documentation, including incorporation papers, business licenses, and identification documents of directors and shareholders. Once the documentation is complete, the application is submitted to the relevant tax authorities. The timeline for processing the application varies depending on factors such as the efficiency of the tax authority and the completeness of the application. Following submission, the tax authorities review the application, verify the information provided, and assess the company’s eligibility for tax registration. Upon approval, the tax authorities issue a TIN, which is essential for fulfilling tax obligations. The resident juridical persons have to follow the post-registration requirements to avoid penalties and maintain good standing with the tax authorities.

Non-resident juridical persons face a distinct timeline for corporate tax registration. Similar to resident juridical persons, non-resident entities must gather requisite documentation and submit the application to the relevant authorities. However, the process may involve additional considerations such as the appointment of a local representative or agent for tax purposes. Once the application is submitted, it undergoes review by the tax authorities, who assess the company’s eligibility for registration. After approval, the procedure is the same as for the resident legal entity.

For natural persons, the timeline for corporate tax registration involves distinct considerations. Individuals engaging in business activities must register for tax purposes and obtain a TIN. The process typically requires the submission of personal identification documents, business licenses (if applicable), and other relevant paperwork. Once the application is submitted, it undergoes review by the tax authorities. They verify the information provided and assess the individual’s eligibility for tax registration. After approval, the procedure is the same as for the resident legal entity.

Failure to adhere to the prescribed timeline for corporate tax registration can result in penalties. Administration penalties of AED 10,000 will be imposed on taxpayers who do not submit their registration applications for Corporate Tax within the deadlines. The severity of the penalty may vary depending on factors such as the duration of the delay and the taxpayer’s compliance history. Proactive compliance with registration deadlines is essential for ensuring smooth operations and avoiding the late registration penalties.

Navigating the timeline for corporate tax registration requires careful planning, preparation, and adherence to procedural requirements. By understanding the various stages involved and proactively managing the registration process, businesses can simplify the process and make sure your tax responsibilities are being met.

Maxims, one of the top accounting and auditing companies in the UAE, has worked hard to meet the diverse needs of its clients. The skilled auditors and accountants at Maxims are well-versed in all the rules and requirements needed to satisfy the needs of their clients. In addition to accounting and auditing services, we also provide our clients strategic tax advisory services. Our experts in Maxims will help you to understand the new Connecticut landscape because they are knowledgeable about all the aspects of the new business tax policy. Speak with our staff right now to be compliant and to learn more about corporation tax.