Skip to content

Skip to footer

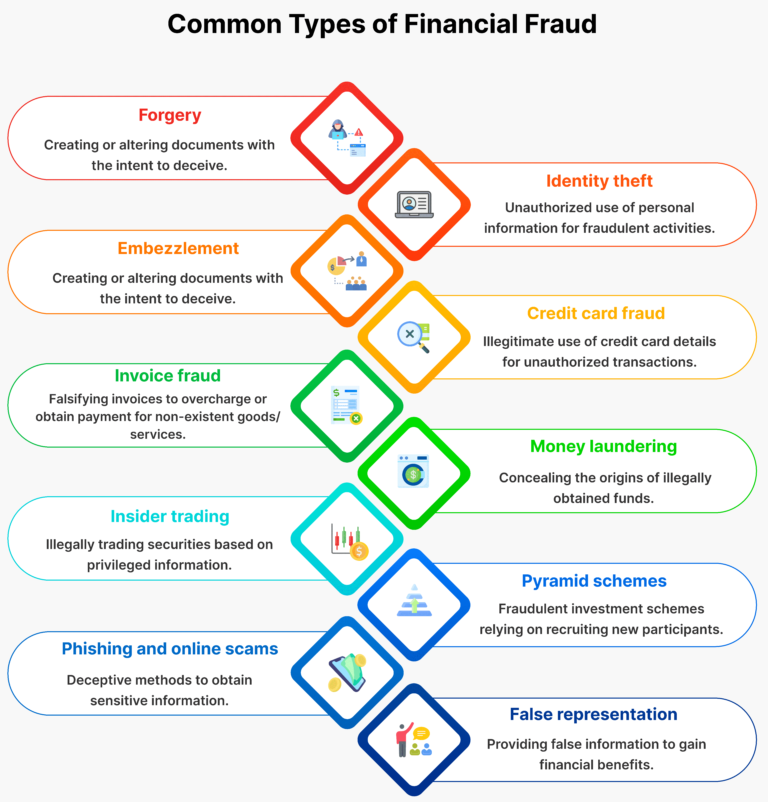

Financial fraud in UAE, refers to a range of illegal and unethical actions carried out with the goal of misleading people, groups, or financial institutions in order to benefit personally. This category of fraud covers an extensive array of strategies and techniques intended to interfere with financial systems, falsify financial data, or illegally acquire money or property. Some, common examples of financial fraud in UAE may include: Embezzlement, Forgery, Identity theft, Credit card fraud, Invoice fraud, Money laundering, Insider Trading, Pyramid Schemes, Phishing and online scams, False representation, etc…

Financial fraud incidents have surged recently due to the greater use of digital transactions and financial technologies. Because cybercriminals have benefited from technological improvements, there are now more ways than ever for them to harm unwary individuals, and their strategies are increasingly complex and difficult to stop. In the first three quarters of the previous year, according to Dr. Mohammed Al Kuwaiti, head of the Cybersecurity Council, over 71 million attempted cyberattacks were blocked in the UAE, where over 50,000 cyberattacks are launched every day.

According to Visa’s annual Stay Secure poll, nine out of 10 people in the UAE are inclined to ignore warning indicators of online criminal behaviour, even if 61% of them think they are informed about fraud. 5,800 adults from Central and Eastern Europe, the Middle East, and Africa were surveyed for the study, which revealed that 54% of UAE residents had been the victim of fraud at least once, and 17% had been duped more than once.

The necessity for businesses to have strong fraud detection procedures is essential in the UAE’s dynamic economic environment. Fraudulent activity is more likely to occur when firms grow and transaction volume increases. Therefore, implementing essential strategies for fraud detection is paramount to safeguarding the integrity and financial health of UAE enterprises.

Establishing stringent internal controls is the first line of defence against financial fraud. This involves segregating duties, conducting regular audits, and implementing checks and balances to deter fraudulent activities.

It is essential to carry out a thorough risk assessment in order to pinpoint potential weak points and areas of concern within your company before putting financial fraud prevention tactics into action. Examining internal systems, procedures, and controls is necessary to identify any vulnerabilities that fraudsters might exploit.

Embrace cutting-edge technology solutions such as fraud detection software and data analytics tools to identify suspicious patterns and anomalies in financial transactions. These tools can provide real-time insights into potential fraudulent activities, enabling prompt intervention.

Educating employees about the various forms of financial fraud and imparting training on fraud detection techniques can significantly bolster your organization’s defences. Encourage a culture of vigilance and transparency to empower employees to report any suspicious activities promptly.

Forge strong partnerships with regulatory authorities and law enforcement agencies in the UAE to stay abreast of evolving fraud trends and regulatory requirements. Engage in proactive dialogue and information sharing to collectively combat financial fraud.

A bookkeeper plays a pivotal role in ensuring the accuracy and integrity of financial records, making them invaluable allies in the fight against fraud. By leveraging a bookkeeper’s expertise, organizations can gain invaluable insights into their financial operations and identify potential red flags indicative of fraudulent activities. From reconciling accounts to scrutinizing transaction records, a bookkeeper’s meticulous attention to detail can uncover discrepancies that may otherwise go unnoticed.

Strong internal controls, conduct-risk assessment, cutting-edge technological solutions, staff awareness campaigns, and collaboration with regulatory bodies are all necessary components of the multidimensional strategy needed to combat financial fraud in the UAE. In the evolving business landscape of the UAE, organisations can reduce the risks associated with fraudulent actions and protect their financial integrity by utilising bookkeeper skills and implementing proactive fraud detection and prevention measures. Stay vigilant, stay informed, and stay ahead of fraudsters to secure a prosperous future for your organization.

At Maxims, we are aware of the challenges involved in navigating the complex and fast-paced business environment of today. For this reason, we are excellent at providing customised outsourced bookkeeping services that are made to match your particular company’s needs. With more than ten years of experience in a variety of industries, we enable your business to grow and prosper in addition to surviving. You can shift your attention to the core business operations by giving us your financial management needs.

Join us as we set off on an exciting journey towards success and growth. When we work together, we may conquer challenges, recognize noteworthy successes, and reach new heights. Reach out us today to discover how our professional bookkeeping services can help your company reach its full potential!